If it’s always been done that way, ask why…

I read an article earlier today about the characteristics of great entrepreneurs. One of those characteristics really stuck out to me. The article explained that great entrepreneurs ask why something should be done a certain way instead of just doing it the way it has always been done.

This has been a sore spot for me recently. I have had several clients who have come to me regarding forming an entity for their small businesses. Many of them had spoken to friends, accountants, insurance people, or even complete strangers about starting a business. These people had been told that setting up an S-Corporation would be the best option for them. Or worse, I have had clients come to me who have already set up an S-Corp based upon someone else’s recommendation, when an LLC would have been a better option.

When I ask the reason why this recommendation was made, the clients have simply responded that an S-Corp has long-been the best option for small businesses. And I agree that, for a long period of time, forming a corporation and electing to be taxed as an S-Corporation was a great option for small businesses.

However, a few years ago, states allowed people to form Limited Liability Companies (LLC’s). In many ways, S-Corp’s and LLC’s are very similar. In other ways they are different, and that is why no one can say that one is better than the other in all circumstances.

In fact, I recommend that you do request the advice of your lawyer, accountant, insurance person, or friend when starting a business. But when their advice is based on what has always been the best for entrepreneurs, and not on what is best for your situation, take that advice with a grain of salt.

In the same regard, if your lawyer tells you to form an LLC because of preferable tax treatment, or your accountant tells you to form an S-Corp for liability reasons, ask yourself whether you should heed your lawyer’s tax advice, your accountant’s legal advice, or whether everyone should be on the same page with issues like this.

Did you know that forming an S-Corporation can cost you significantly more money than forming an LLC? S-Corporations are required by law to advertise their creation, as well as conduct annual shareholders and board of directors meetings. These additional requirements obviously cost some money, and are not necessarily required if you are operating as an LLC.

Thus concludes my rant on S-Corps and LLC’s for the evening. If you are thinking about starting a business, take the advice of the professionals you work with, and make an informed, educated, intelligent decision. Don’t just do what has always been done.

Erie County PA Property Tax Assessment Appeals

Erie County has mailed reassessment letters to local homeowners. If you are unhappy with your new assessment, you have the right to file an appeal through the Erie County Tax Assessment Office.

If you need the assistance of an attorney because you are unsure of the procedure, contact Erie Attorney, Adam Williams. The overall process is intended to be “revenue neutral,” which means that the County should not collect any more or less tax revenue because of the assessment. Basically, if your assessed value increased, someone else’s assessed value decreased, and the amount of tax revenue remains the same.

10 Tips for starting a business in 2012

There are countless lists of tips for starting a business. No list is exhaustive, and each list usually contains at least one good point.

The Gannon Small Business Development Center recently posted this article on starting a small business in 2012. The list contains some very good, very practical suggestions. I really like numbers 8, 9, and 10. However, I think the most important is #6: developing a solid marketing plan.

Too frequently, entrepreneurs jump into an endeavor without a solid grasp of who the customer will be, what the competition is doing, or without performing a thorough SWOT analysis. I can tell you that, even as an attorney, a SWOT analysis is important to the success of my practice.

So, check out the article, do your homework, and if you have a good idea, consider attending one of the “First Step” classes at the Gannon SBDC.

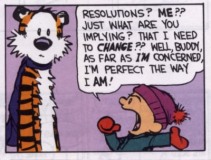

What’s your Resolution?

This year, my wife and I did something for New Year’s Eve that we haven’t done in years: we left our house. The Brewerie had a party, which included a live band and a DJ. We had a great time. We spent time with friends. We made new friends. And we discussed our resolutions.

We shared the typical new year’s resolutions: lose weight, pay off debt, save money. But a friend of mine had a novel resolution that was music to my ears. 2012 is go

ing to be the year that he quits his job and starts a business in Erie.

People have lots of reasons for starting a business. Perhaps they don’t

like their current job. Maybe they see a way that they can improve on a product or service.

Whatever the reason, will 2012 be the year that you take the plunge?

Unemployed? Unhappy with your job? Start a business!

When I was in college, I used experience that I had gained at one job to start my own business. There were positive aspects of my prior employer, which I used in my business. But there were also many areas that I thought my prior employer could improve. I used those to gain a competitive advantage when I went out on my own. Using your prior experience, whether as a competitor, or as a complementary product or service, can help you get through the growing pains of starting a business more quickly. If you’re unemployed and looking for a job, have you thought of going out on your own?

If you are thinking of starting a business, check out this flyer I developed recently.

I had been thinking a lot about the “Occupy Wall Street” movement that is occurring right now. I intended to write a post explaining that those who are protesting are unemployed, and should try to start their own business. Entrepreneur.com wrote the article before I could. Check it out: Don’t Occupy Wall Street, Start a Business

A checkup for your business

I have had a lot of clients coming to me recently with major problems that could have been avoided with some “preventative maintenance.” Many people start a business without considering the long-term implications of their actions. Then, when a problem arises down the road, whether it’s with an employee, a customer, or a business partner, the issue is expensive and time-consuming to resolve.

As a result, I have recently begun offering “checkups” for your business. I will examine your company’s operations, its important legal documents (e.g., bylaws, operating agreement, etc.), and other relevant areas. I will then identify potential risks and areas of concern, and the steps that you can take to avoid headaches in the future. Please contact me to schedule a “checkup” today! Much like going to the doctor, don’t be afraid of what this checkup may expose. It will be good for your company’s long-term health.

4 legal pitfalls startup owners must face | VentureBeat

4 legal pitfalls startup owners must face | VentureBeat.

I found this article via a “retweet.” I may start paying more attention to venturebeat.com.

Initiative tries to link veteran-owned businesses – Local News – GoErie.com/Erie Times-News

I think I would be more likely to support a veteran-owned business if that type of information was better publicized. I owe those guys (and girls)!

via Initiative tries to link veteran-owned businesses – Local News – GoErie.com/Erie Times-News.

Wheres the best state to incorporate your business

Wheres the best state to incorporate your business.

99% of the time, it’s whatever state you’re doing business in. You don’t need to incorporate in Delaware or Nevada if your business will only be operating in Pennsylvania. Contact my law office to incorporate your PA business or to form an LLC.